Does timing matter when investing regularly? Have you asked yourself, should I watch the market regularly and decide actively when to invest my money, or is it better to put my investing on autopilot and let it go? Would it make a difference?

Disclaimer

Firstly disclaimer. I am not a financial advisor, and I don’t intend to be. The articles on this site are meant for educational purposes and should inspire thinking. Make your own decisions and seek the help of professionals when you deem useful.

Although I will be using quite precise numbers, take them with plenty of respect and consideration. These are the past data that can tell us something about the past but are not guaranteed to repeat in the future. In addition, this is a simple analysis to get us a ‘feel’ for the strategies not to get exact answers. The future is unpredictable so bear that in mind, please.

Market

When people talk about the market, mostly they talk about investing in the indices. In simple terms, the index is a portfolio of shares that represent the market. There are various types, for this analysis I will use the S&P 500. This index consists of 500 large companies in the US. Thus, buying the S&P 500 index allows us to buy a proportion of 500 companies all at once and thus get a diversified portfolio.

Strategy and data

To find out whether timing the market is worthwhile I decided to take a simple approach. I will compare 2 strategies:

- Not timing the market: Invest $100, regularly every month at the best possible price within a month.

- Timing the market: Invest $12,000 every 10 years at the best possible price within those 10 years.

The first strategy simulates ordinary life situations. You go to work, earn your salary which gets paid monthly. You then, without analyzing the market invest $100 of it. The price can be high or low you do not check it just buy it. In our example, we assume that you are so lucky, that every month you buy stocks at the lowest possible price during that month.

The second strategy is more elaborate. You think you can predict the market thus you will trust your skills and invest a larger amount. You can time the market so well that over every 10 years you can get the lowest price in the market. Well done you! To make results comparable with the first strategy you need to invest $12,000 every 10 years ($100 a month will invest $1,200 a year. Do that for 10 years and you will arrive at $12,000).

Start and end dates

I will use historical daily prices starting on 1st January 1990 ending on 31st December 2019. That is 30 years of data. I understand that going further in the past can give us statistically more robust results. However, the economy and markets changed so much in recent years (like negative or near-zero interest rates) that I want to put more weight on the recent prices.

What is the best possible price?

The best possible price is simply the lowest price you can get. The lower the price at which you buy the better (with exception of 0 of course which would mean bankruptcy).

For our first strategy. That is the lowest price over a month at which we will buy the index (or proportion of it worth $100). For our second strategy, we will buy at the lowest price over 10-year periods. The investment will be $12,000 as explained above. Total investment for both strategies over 30 years (360 months) will be $36,000.

So, does timing the market matter?

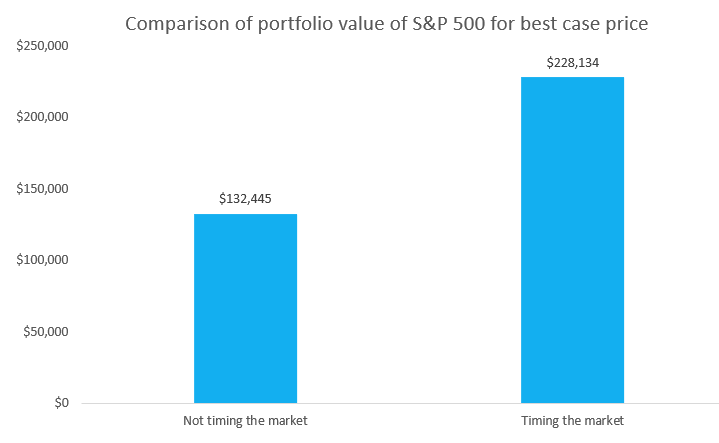

A comparison of the results supports strategy #2 and that is timing the market can make way more money than regular investing.

I think this is nothing ground-breaking. If you invest small amounts of money in shorter periods you will average out big swings in the prices. Thus, your investments will not change in value a lot. As a result of this smoothing effect, you will also lose some potential profit. This is confirmed by the results of the second strategy. This strategy would have made almost $100,000 more (or about 70% more) under the condition that you always guess the right price. You will buy more of the index at the lower price thus will benefit from its growth more.

What are the issues with timing the market?

The above results do not paint the whole picture. We looked at the positive side of the result only i.e. the reward. We assumed to always buy at the best price available. What if we were not successful at guessing the market right? What if we guessed it so badly that we would buy at the highest price instead of the lowest? It is time to look at the negative side of investing i.e. the risk.

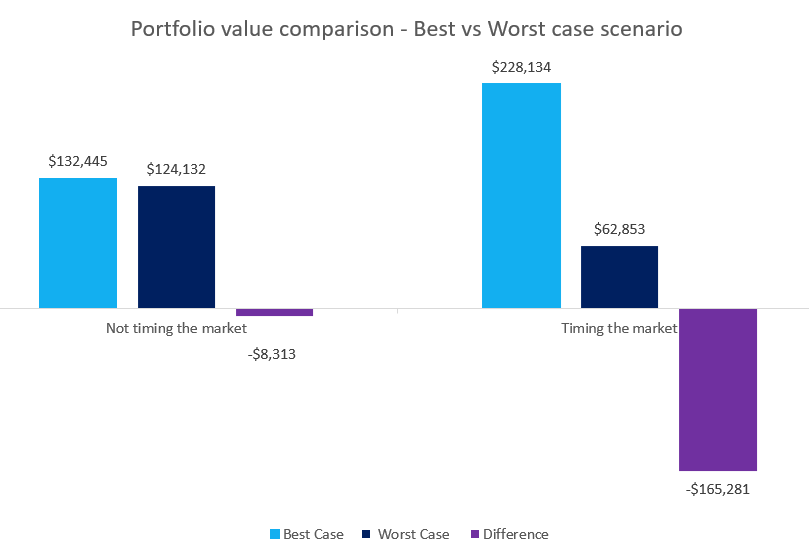

I like this approach a lot. By looking at the negative extreme point we could see the potential risk of the above strategies. Knowing extreme points can give us valuable information on how our estimated results can vary. If the difference between the best and the worst-case scenario is small it could be a good indication that the results should be stable (and thus strategy is of lower risk). The large difference, on the other hand, indicates that results can vary a lot. They can provide more return but at a higher cost (risk).

The analysis of extremes yields way different outcomes. Have a look at the chart below.

Suddenly our “Not timing the market” strategy does not look that bad, does it? The result differs by only about $8,000. Whereas “Timing the market” strategy results in a whopping change and returned almost $165,000 less than our best-case scenario.

How can I use all this?

Based on our simple analysis we showed that timing the market indeed can produce better portfolio returns compared to regular investing. This, however, comes at a cost. The cost is represented by a large risk that this strategy brings with it. If you time it incorrectly the results will be much worse than investing regularly.

Therefore, if you trust your market timing skills and they turn out to be correct you can outperform someone not reading the market and investing on autopilot.

Alternative ideas on how to use the 2 strategies

The great news is that you do not have to decide to go only one way. You can combine the 2 strategies and reap benefits (and suffer the risks) of them both at the same time. To find out how and what the outcome could be, visit my website again. I will try to post the link to the analysis here.

In the meantime enjoy our new Timing vs. not timing the market – Calculator where you can set your own parameters and assess your situation.

Questions for the future?

Naturally, you can (and should) have more questions. While writing this post few of them popped up and I plan to address them in the next series of posts.

Firstly, extending our analysis of other indices would be beneficial. So far we looked at 1 index on the US market, but what about looking at the other indices? Dow Jones 30? Nasdaq? Indices in Europe? Asia? There are many markets and many indices and it would be interesting to see how the 2 strategies perform. As I enjoy the fun of finding out I plan to post more so stay tuned.

Secondly, would assuming different periods make a difference? What if we invested every 5 years? Or started 10 years later? Or sooner? How much of a difference would this make?

I created the calculator with which I try to address the 2 points above. Try it out in my next post Timing vs. not timing the market – Calculator.

Thirdly, does it matter when we start investing regularly? Is it worth waiting for markets to drop from current high levels? Does timing the regular investment make a difference? Or the time in the market is what matters?

Pingback: Timing vs. not timing the market – Calculator. – Everyday Quant