Every little helps

Have you ever wondered if buying that $4 coffee, or a couple of beers for $7 each in your favorite place has any impact on your financial situation? Probably not, but don’t worry I did it for you.

Imagine you can stop your unnecessary spending and instead invest it in the index funds. This does not mean you cannot have a coffee, but you can make it yourself for only around 20 cents. Such small changes in your spending habits can make a huge difference over a long time.

Impact of saving $20 and $50 a week on your finances

So what is the impact if you skip paying $4 per coffee a day for 5 years? For simplicity, I assume you would spend only $20 a week on coffee. And you invest this money every week on any day while markets are open in some index, say S&P 500. I analyzed 2 scenarios. The best-case scenario – you buy at the lowest price of the index in that week. Lucky you! The second scenario is that you are the unluckiest person and always buy at the highest price each week. The result will give us a nice comparison of what would have been the best and worst-case scenario for us. In reality, we would probably end up somewhere in the middle.

As of writing this post (28th October 2020), you would have saved $5,240 over 5 year period (starting 28th October 2015). This investment would turn into $6,778 in the best-case scenario and $6,597 in the worst-case scenario if invested into S&P 500 index (you would invest $20 every week not the whole sum at once).

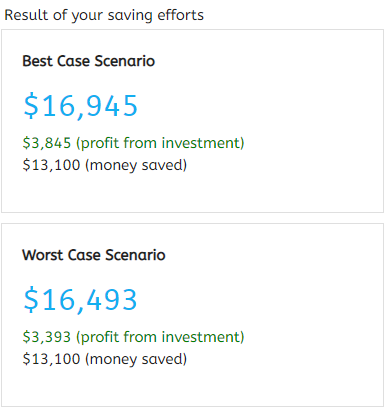

What about that Friday night out in your favorite pub or bar? How much do you spend there? Let’s say you enjoy that night with $50. How much would you end up with, in this case? Well, a staggering $16,945! Even if you were super unlucky and invested always at the highest price during each week you would still end up with a very healthy $16,493 or 25.9% more than what you would have saved.

Thus think twice before you buy that coffee or order another drink. Every little helps. In just 5 years your finances could look much better.

Saving small amounts – backtesting calculator beta

In the calculator below you can select how often you want to save, how much can you save, financial instrument, and the period over which you want to back-test your situation.

Play with the calculator and see how much you could have accumulated over the past.

Disclaimer

I am not a financial advisor, and I don’t intend to be. The articles on this site are meant for educational purposes and should inspire thinking. Make your own decisions and seek the help of professionals when you deem useful.

Although I will be using quite precise numbers, take them with plenty of respect and consideration. These are the past data that can tell us something about the past but are not guaranteed to repeat in the future. In addition, this is a simple analysis to get us a ‘feel’ for the strategies not to get exact answers. The future is unpredictable so bear that in mind, please.

Feedback is welcome

Please play with the calculator and let me know what you think. Also if you see any bugs or want to have the latest data or some other indices please let me know and I will try to update and improve the calculator.

Just email me at contact@everydayquant.com

Happy calculating!